Parity was maintained through the ‘ specie flow mechanism.’ (see David Hume)Ī country can use multiple types of money if there is no prohibition against it. The parity remained the same among all currencies. Though the units may have been labelled differently based on the gold returnable (the rupee was supposed to be worte 2.88 grains of gold when the central bank was set up in 1950) and the US dollar one 35th of a troy ounce or 13.71 grains.

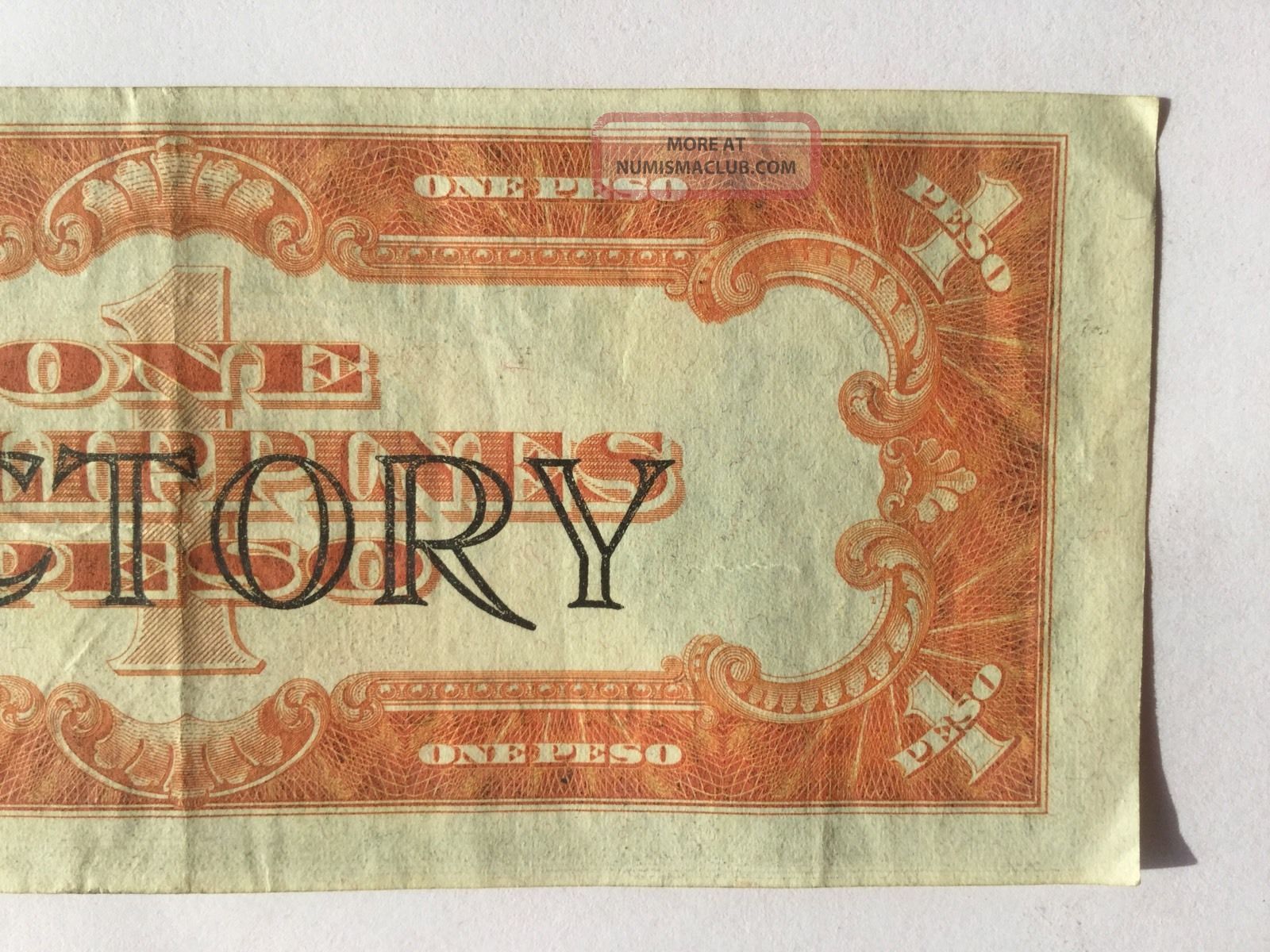

Therefore all countries had an unchanging ‘exchange rate’ one can argue. The parity between Sterling and the US dollar was unchanged unless there was a policy error. Under the classical gold standard therefore exchange rates did not change. Under the classical gold standard all countries had a fixed exchange rate, all money had the same anchor – gold. But gold is just something dug up from the ground. Until 1971 ( or the 1934 Gold Reserve Act) when US citizens were banned from holding the metal) gold was money. What is the connection between the exchange rate (parity of the note issue of one central bank with another) and the economic performance of a country? The India and Ceylon Rupees were originally silver or pegged to silver, which is another way of saying that paper money has been issued like a cheque against a bank account balance of silver or gold, just as a person in the present day may issue a cheque against the current account balance. The best one found so far in human history seems to be gold, but silver has also been successfully used. Throughout history, sound paper money had been pegged to a valuable non-inflating (relatively rare) asset and the asset itself has been circulated in parallel. That such ideas are misguided can be readily seen in the ‘undervalued’ exchange rates of Sri Lanka and the supposedly ‘overvalued’ exchange rates of currency boards and almost all East Asian nations.Ī fixed exchange rate is so-called because it is fixed or anchored to some asset or currency which does not inflate fast and preserves its value. Mercantilists have used false econometrics like the real effective exchange rates (REER) to attempt to link currency to trade. That fixed exchange rates are unstable seems to be a myth spread by Keynesians and other Mercantilists who are unaware of banking in general and monetary history in particular after Keynesian stimulus shattered pegs wholesale.Ī fixed exchange rate is simply a type of monetary system with a particular type of anchor. Fixed exchange rates are not artificial or unviable or unstable. The monetary base of a country is a whole bunch of bearer cheques, which are cashed at the central bank for dollars if there is a fixed or pegged exchange rate and not cashed of there is a floating exchange rate.Īre fixed or pegged exchange rates artificial? Are they inherently unstable? In fact for all intents and purposes rupee notes are bearer cheques.

.jpg)

#Sri lanka rupee to usd free

These notes are an interest free liability of the central bank like an IOU or a bearer cheque. The power – and the problem – of central banking comes from its ability to issue these notes which people exchange for goods domestically and abroad by exchanging with foreign currency. Standard Chartered still issues money in Hong Kong, subject to the rules of the Hong Kong Monetary Authority. In many areas of the British Empire, the Standard Chartered Bank and its affiliates issued money which was very much more stable that those issued by the later state central banks. In Ceylon such regulated money was first created by the Oriental Bank Corporation which was a chartered bank and the Chartered Mercantile Bank of India, London and China. In Ceylon there was Ordinance No 23 of 1844. In connection with Sri Lanka this happened with the Bank Charter Act of 1844 in the UK, which limited the ability of banks to create money, to Bank of England in the UK and later in the Empire. Any number of banks can create these notes in a given territory – and in the free banking era they did – but later governments limited this ability to one bank, giving it a note-issue monopoly. What is a central bank? And what is a bank note?Ī central bank is a bank which can create paper notes which are exchangeable for goods and foreign currency.

0 kommentar(er)

0 kommentar(er)